A couple of investment companies modified their positions in Air Products

| Roger A.

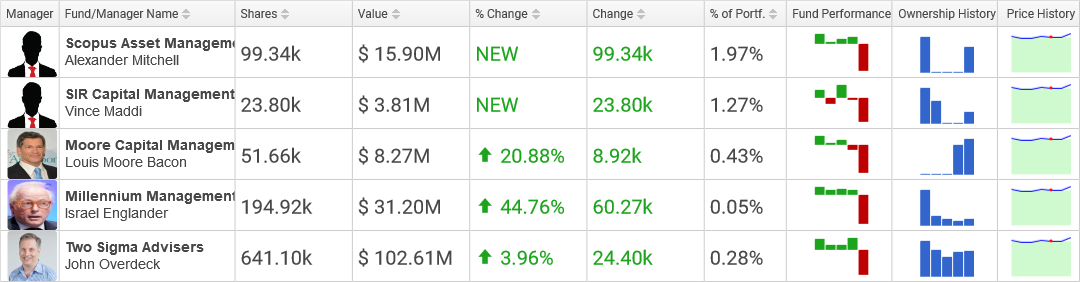

Hedge Funds Buying APD

Moore Capital Management has been raising its holdings in APD in the prior year, purchasing 42,732 shares in the 2nd quarter and an additional 8,924 shares in the 3rd quarter, enlarging the cumulative number of shares owned by the hedge fund to 51,656. The hedge fund now owns an $8.3 million position in APD, representing 0.43% of the hedge fund's holdings. This evaluates to a growth of 20.88% over the previous quarter's 42,732 shares.

Millennium Management loaded up 60,268 shares of APD, increasing the aggregate number of shares held by the firm to 194,924, valued at $31,198,000. This equals a growth of 44.76% over the past quarter's 134,656 shares. APD now makes up 0.05% of the fund's stock portfolio.

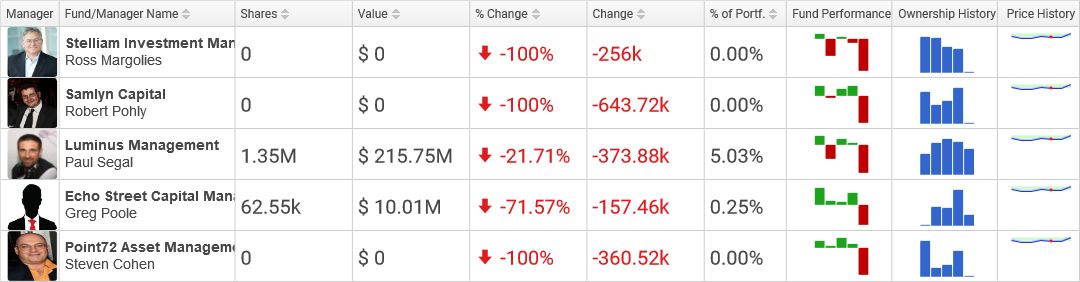

Hedge Funds Selling APD

Samlyn Capital liquidated its $105.3 million holdings in Air Products. The firm off-loaded 643,715 shares of the company in the prior quarter.

Following the sale of 157,459 shares, Echo Street Capital Management now owns a $10 million investment in Air Products comprising 62,555 shares. Air Products now represents 0.25% of the fund's holdings. This equals a drop of -71.57% over the last quarter's 220,014 shares.

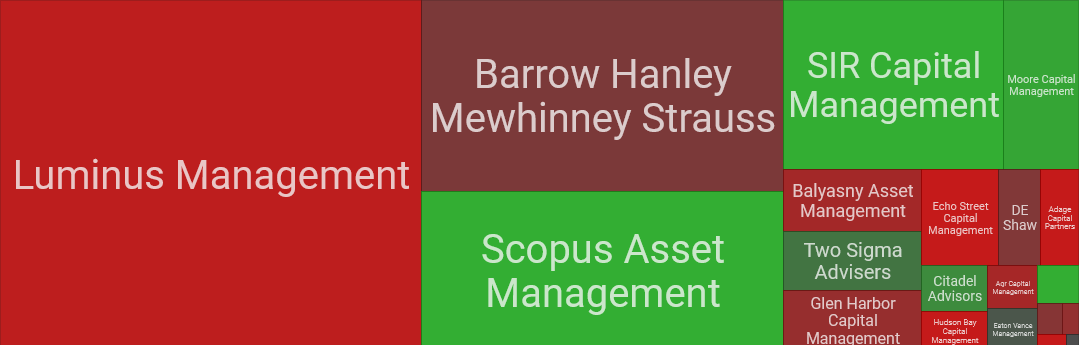

Top Holders of APD

Barrow Hanley Mewhinney Strauss has been shrinking its investment in APD during the last year, selling 150,979 shares in the 2nd quarter and an additional 282,764 shares in the 3rd quarter, reducing the total number of shares held by the hedge fund to 7,485,650. The fund now has a $1.2 billion stake in APD, making up 2.36% of the hedge fund's investment portfolio. This adds up to a decrease of -3.64% over the last quarter's 7,768,414 shares.

Scopus Asset Management raised its stake in APD by 99,343 shares, bringing the total number of shares held by the fund to 99,343, worth about $15,900,000. This evaluates to an increase of% over the prior quarter's 0 shares. Air Products now represents 1.97% of the firm's portfolio.

APD Stock Price

APD moved upwards 0.81% on Friday, touching a day's high of 181 before moving down to close at 180.12. The stock kick started the day at 179.82, around 0.64% on top of its previous close of 178.67. APD is trading 21.34% away from its year low price of 148.44 and is very close to its trailing year high of 180.72. APD has a significant PE ratio of 23.54 and a dividend yield of 2.58%. The company has a market cap of $39.56B.

APD moved upwards 0.81% on Friday, touching a day's high of 181 before moving down to close at 180.12. The stock kick started the day at 179.82, around 0.64% on top of its previous close of 178.67. APD is trading 21.34% away from its year low price of 148.44 and is very close to its trailing year high of 180.72. APD has a significant PE ratio of 23.54 and a dividend yield of 2.58%. The company has a market cap of $39.56B.