Guide to Hedge Fund Investing

This is a short course that teaches the basics of tracking hedge funds and their investments using HedgeFollow. All investors are strongly encouraged to carefully read this page, since even intermediate investors may not have heard of some of the terms discussed below.Prerequisites

You are expected to know the basics of investing and some terminology such as long/short, small-cap vs large-cap stocks, etc.Course Contents

Types of Funds

If you do a google search about the different kinds of funds out there you'd typically find that funds are often categorized according to their legal definitions. They'll talk about differences between hedge funds, mutual funds, close-end funds, etc. At HedgeFollow, we use the term "Hedge Fund" loosely to describe any investment company that buys and sells stocks. We are less concerned whether the investment company meets the legal definition of a "hedge fund" and more concerned with whether it is worth studying the investments of this company.In fact, Berkshire Hathaway is technically a holding company, not a hedge fund. However, because Warren Buffett is one of the most successful investors in history, the investments made by Berkshire are tracked by thousands of investors, Wall Street outlets, and even other hedge fund managers. Then again, some of the investment companies that do meet the legal definition of a hedge fund can be terrible candidates to follow, the reason being they employ high-frequency quantitative trading strategies that are impossible to follow from simply looking at their regulatory filings.

HedgeFollow tracks ALL institutional investors that submit filings to the SEC, regardless of whether they are a hedge fund, holding company, etc.

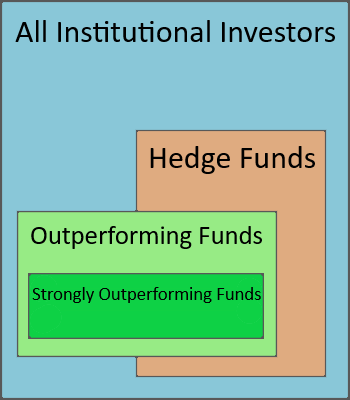

However, for analysis purposes, we pool funds into 4 groups:

1- "Hedge Funds"

This group of course includes famous hedge funds such as those managed by Michael Burry and Bill Ackman. However, it also includes all hedge funds, private equity, venture capital, and other private funds that file 13F to the SEC. Also included are famous institutional investors such as Warren Buffett that may not technically be a hedge fund.2- All Institutional Investors

This includes ALL funds tracked by HedgeFollow. This means all "Hedge Funds" described above, along with many large banks, pension funds and all other institutional investors that file 13F to the SEC.Some large institutions belong here, such as JPMorgan Chase, Morgan Stanley, Ubs Group Ag, etc.

You might notice that some of these funds are very large and can contain thousands of stocks in their portfolios. Nonetheless, many investors like to follow them, and try to discern whether they internally rate stocks outperform/underperform based on how they rebalance their portfolios every quarter.

3- Outperforming Funds

HedgeFollow assigns ratings to funds based on their performance (see how we rank Hedge Funds). Funds that receive 3+ stars rating are considered outperforming funds. By grouping funds like this, we can answer interesting questions, such as what are the most bought stocks among outperforming funds? Most sold? Most held? And many more that you'll find across HedgeFollow.4- Strongly Outperforming Funds

These are funds that receive a 4+ star rating. They represent the top 20% of all rated funds.

Tracking Hedge Funds

To make the best use of HedgeFollow as an investing resource, it is important to understand how we track hedge funds. By law, hedge funds are required to periodically file documents disclosing their ownership of stocks, options, and some other securities. There are two main types of filings you should know: Quarterly filings and non-quarterly filings.Quarterly 13F Filings

Hedge funds that manage over $100 million are required to quarterly submit a list of all their stock holdings, including options and some other securities. This document is known as the 13F, and it must be submitted within 45 days of the end of the quarter. For example, funds must detail what stocks they owned on December 31st of 2022, and they have until February 14 of 2023 to do this. These quarterly 13F filings are used by most of the heatmaps and graphs you see on HedgeFollow that summarize quarterly hedge fund activity.13F Reporting Dates

13F filings require funds to detail their ownership AS OF the end of the quarter. For this reason, you will notice that many records on HedgeFollow have the same reporting date (last day of a quarter, for eg. 2023-06-30).Non-Quarterly 13g/13d Filings

When a fund buys a large amount of the stock of a company (over 5% of the company's shares), they are required to publicly disclose their purchase in 13g or 13d filings. In many cases they are required to do this promptly (they are not allowed to wait until the end of the quarter). Often the deadline for this type of disclosure is 10 days from the date of their purchase, but the deadline sometimes depends on the nature of the fund and whether it intends to influence the management of the company. Thus it is possible to keep track of the latest activity of hedge funds by following 13g and 13d filings. They can happen anytime, anyday, except for public holidays.When funds buy a huge chunk of a company they typically have two possible objectives:

Passive Investing (13g filing)

Here the fund believes the company is a good investment. The fund is satisfied with how the management is running the company and they made a big investment because they believe the value of the stock will appreciate over time. They typically file a Schedule 13g in this case.Activist Investing (13d filing)

Sometimes the fund believes the company is undervalued, or that it has potential to grow, but needs a little push. If the fund bought the stock with the intention of actively influencing the management (by for example, pushing for board seats and influencing the company's decision making), then the fund is required to disclose this intention. This is done by filing a schedule 13d (rather than the 13g filed when passively investing).This is where hedge funds differ from the typical average investor. If you are reading this, chances are you fall into the passive investor category. You buy the stock and hope the company management is competent and pray that the stock price rises.

Activist investors are different. Many hedge funds won't sit on a huge investment and just wait to see how things will turn out. They would perform actions that they hope will increase the stock price. For instance, Greenlight Capital bought a large stake in GM many years ago. David Einhorn, the fund manager, believed it was undervalued (as did many frustrated stockholders at the time). He pushed for corporate action that would split the stock into a dividend-paying stock and a growth stock in hopes of unlocking shareholder value. Eventually the stockholders sided with GM against Einhorn, but the drama between the two brought GM into the spotlight. In fact, the stockholders rejection of Einhorn's proposal was interpreted by many people as a sign of their confidence in the company's management.

Non-Quarterly SEC Form 4 Insider Filings

In addition to 13G/13D filings, there is another non-quarterly form that is submitted to the SEC by some institutions and individuals. When company insiders (such as CEO, CFO, Directors, etc) purchase or sell company stock, they are required to report these transactions to the SEC. This filing is called the Form 4, and usually must be filed promptly within 2 business days of the transaction.In addition to company insiders, any institutional investor (such as hedge funds) that acts as a company insider (eg. director) OR that owns 10% or more of a stock must also file a Form 4. Hence we can also use this form to track hedge funds in addition to company insiders.

Using HedgeFollow to track latest Activity

You can see the latest activity of hedge funds using the Hedge Fund Tracker, which tracks ALL the SEC filings we discussed above. Furthermore, you can build your owner tracker by following stocks/funds, then heading over to my tracker.Weaknesses of tracking Hedge Funds

This mini-course would not be complete without seriously discussing the weaknesses of following hedge funds. The following are the major challenges we found when building investment strategies using hedge fund portfolios.Filing Delay

The most obvious weakness of quarterly 13F filings is the delay. The majority of hedge funds file their 13F right before the deadline. This means a delay of 45 days is typical. The question to ask is whether it is useful to know what stocks a hedge fund owned 45 days ago. The answer depends on the nature of the fund's investment strategy (long term vs short term).

Counter Argument: Many hedge funds use long-term investment strategies,

it is unlikely that their portfolios will look so different after only 45 days. In fact, many funds build up their positions over several months. You can see this from a staircase shape in the "Ownership History" column.

Furthermore, by separating outperforming funds, we can discern which funds are likely to employ long term strategies.

And lastly, non-quarterly filings do not suffer this delay, and are often filed promptly after a trade.

Only 13F Securities are Filed

Funds do not have to report ALL their investments. They only have to report ownership of stocks that are designated as a "13F Security". Many foreign stocks and bonds are not designated as 13F securities. This means that tracking hedge funds is somewhat limited to the US markets. Some hedge funds that focus their investments in developing markets in Asia/Europe, and these are harder to track. Thus for many funds what we see is an incomplete picture of their portfolios. The more a fund invests overseas, the more incomplete the picture.Counter Argument: Many hedge funds focus their investments in US markets, so 13F securities cover most of their portfolio. Furthermore, many funds invest in foreign markets through ETF's and investment products that are 13F securities. Note that more than 8,000 US stocks are actually designated as 13F securities. This includes virtually all the US public companies you've ever heard off. Furthermore, hundreds of large foreign companies (Ali Baba, Toyota, etc) are actually listed on American stock exchanges and designated as 13F securities.

Only Long Positions

Funds are only required to report long positions. That is, they are only required to report securities that they have bought. They do not report short positions. This means that it's possible a fund purchased a stock as a hedge against a short bet that was made on another stock. We don't see the short bet, we only see the long position. This might lead us to believe the fund is investing in the stock, when in reality it is simply using it as a hedge.Counter Argument: Many hedge funds employ a long-only investment strategy. That is, they do not get involved in short selling stocks. These funds are very interesting to watch, because we know for a fact that they are betting on their stocks to increase in value. Furthermore, many hedge funds use put options to hedge (rather than shorting). Funds are required to report put options on their 13F stocks, hence we can see such hedges.

Why is HedgeFollow Better?

Tracks ALL Institutions & Insiders

Some websites only track a few famous hedge funds, hoping to gain clicks from their fame. This gives a distorted incomplete picture that suffers from many problems and bias.Because HedgeFollow tracks ALL filers, it provides a comprehensive overview of what institutions & insiders are doing.

Millions of records are curated and processed into visualizations/summaries to provide an exclusive overview only available at HedgeFollow.

Up to Date

Some websites track only quarterly filings, therefore missing out on many trades. This is because non-quarterly filings are messier and more difficult to merge with quarterly filings.HedgeFollow tracks all SEC filings, thus ensuring we don't miss any trades. Furthermore, HedgeFollow merges the latest data from all the different filing types.

When you view a fund's portfolio on HedgeFollow, you are seeing the latest known portfolio of that fund, which reflects the information contained in ALL filings made by that fund up to this point in time.

Massive Data Cleaning 1,000,000+ Errors

Since inception, HedgeFollow has corrected more than 1 million errors in fund filings! This is not some number we're throwing out there, we really have corrected that many errors. Fund filings are RIDDLED with errors. Funds often make mistakes and typos, most of which go unnoticed into the SEC database.The problem with other websites is that they just pull filing data and dump it onto their pages. When you just pull and dump dirty data, you import all the errors and issues with that data. These errors are then propagated into any summaries and aggregations that are performed.

HedgeFollow on the other hand, has dozens of massive data cleaning and sanitization processes, and our expert data scientists are continuously working on our data quality controls. That is why HedgeFollow always has the best data. Of course, some errors will persist, as that is inevitable when processing millions of records, but we work daily to minimize those.

In 2024, HedgeFollow will begin reporting major errors to the SEC so they can be corrected for the public good. Furthermore, we will roll out our Enterprise Plan, which enables funds to see errors in their filings so they can correct them using amendments.