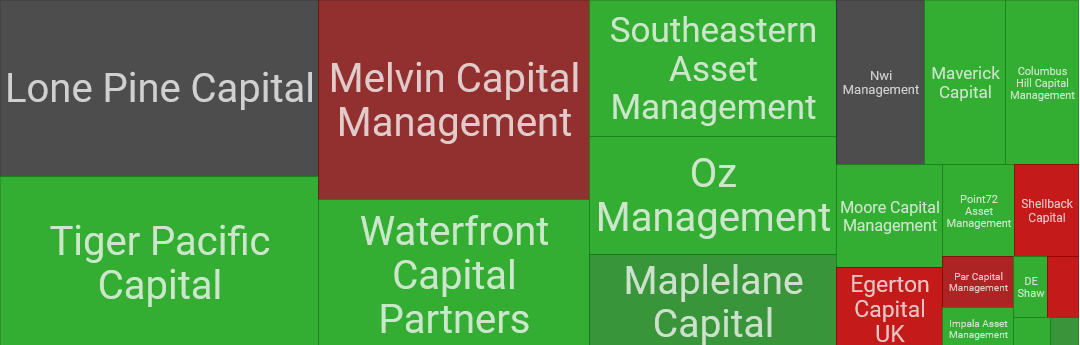

A few investment funds have been adjusting their investments in WYNN

| Patti D.

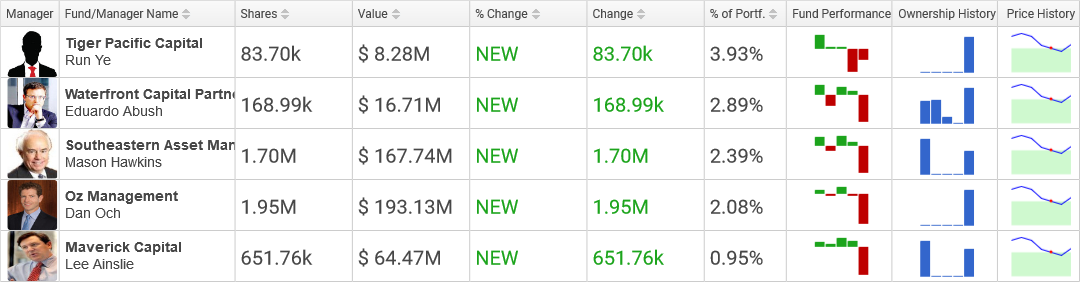

Hedge Funds Buying WYNN

Oz Management purchased a new $193.1 million position in Wynn Resorts. The hedge fund bought 1,952,635 shares over the prior quarter, representing 2.08% of the fund's investment portfolio.

Maverick Capital acquired a new $64.5 million stake in WYNN. The fund added 651,760 shares throughout the prior quarter, making up 0.95% of the firm's investments.

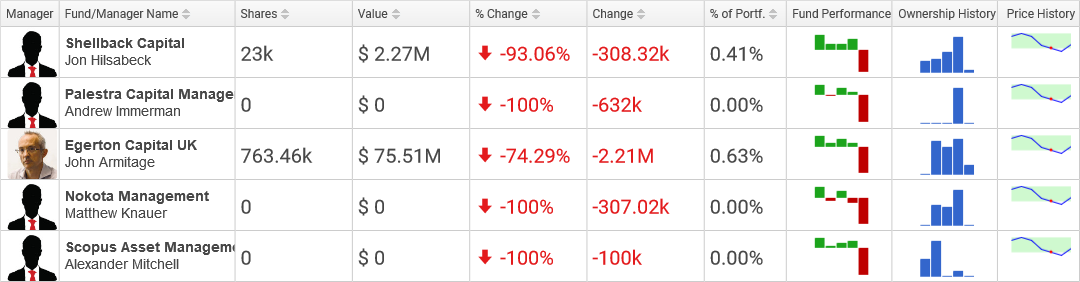

Hedge Funds Selling WYNN

Palestra Capital Management closed out its $71.4 million investment in WYNN. The hedge fund dumped 632,000 shares of the stock throughout the past quarter.

Egerton Capital UK lowered its holdings in Wynn Resorts by 2,205,581 shares, bringing the cumulative number of shares owned by the firm to 763,460, worth about $75,514,000. This evaluates to a decrease of -74.29% over the previous quarter's 2,969,041 shares. Wynn Resorts now constitutes 0.63% of the hedge fund's stock portfolio.

Top Holders of WYNN

Tiger Pacific Capital picked up 83,700 shares of WYNN, growing the aggregate number of shares held by the firm to 83,700, valued at $8,279,000. This equals an increase of% over the prior quarter's 0 shares. Wynn Resorts now constitutes 3.93% of the firm's investment portfolio.

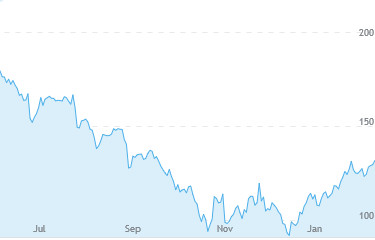

WYNN Stock Price

WYNN declined 1.94% on February 25th, falling to a low of 129 before climbing to end the trading session at 129.20. The stock kicked off at 133.34, roughly 1.21% greater than its previous close of 131.75. WYNN is floating faraway from its 12 month low of 90.06 and is more than 30% away from its 52-week high of 202.48. WYNN has a dividend yield of 2.32% and a sizable P/E ratio of 24.39. The company has a market cap of $14.05 billion.

WYNN declined 1.94% on February 25th, falling to a low of 129 before climbing to end the trading session at 129.20. The stock kicked off at 133.34, roughly 1.21% greater than its previous close of 131.75. WYNN is floating faraway from its 12 month low of 90.06 and is more than 30% away from its 52-week high of 202.48. WYNN has a dividend yield of 2.32% and a sizable P/E ratio of 24.39. The company has a market cap of $14.05 billion.