A few wealth management firms have been modifying their holdings in Davita

| Bradley S.

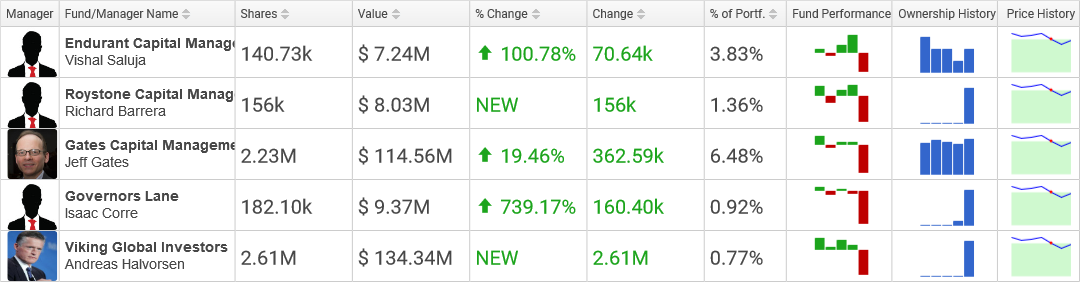

Hedge Funds Buying DVA

Governors Lane has been increasing its stake in Davita during the past few quarters, snapping up 21,700 shares in the 2nd quarter and another 160,400 shares in the 3rd quarter, enlarging the cumulative number of shares owned by the hedge fund to 182,100. The firm now has a $9.4 million investment in DVA, constituting 0.92% of the hedge fund's investments. This represents an increase of 739.17% over the previous quarter's 21,700 shares.

Viking Global Investors bought a new position in DVA valued at $134.3 million. The hedge fund acquired 2,610,629 shares over the past quarter, representing 0.77% of the fund's stock portfolio.

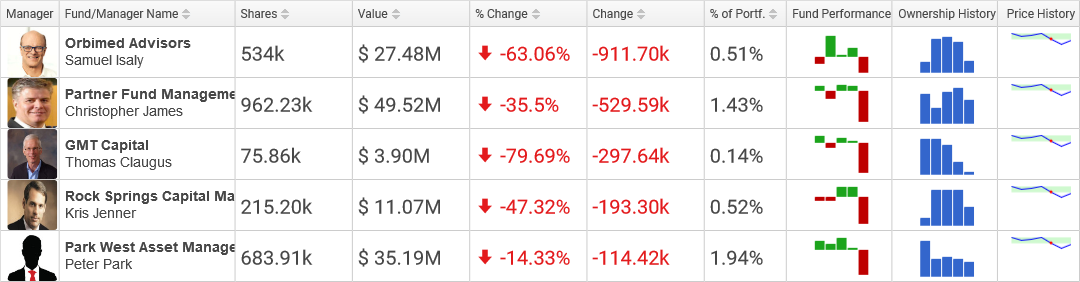

Hedge Funds Selling DVA

Partner Fund Management deflated its holdings in Davita by 529,592 shares, dwindling the total number of shares held by the hedge fund to 962,234, worth about $49,517,000. This amounts to a decline of -35.50% over the previous quarter's 1,491,826 shares. DVA now constitutes 1.43% of the firm's investments.

GMT Capital has been dumping Davita shares throughout the past year, selling 532,300 shares in the 2nd quarter and 297,639 more shares in the 3rd quarter, decreasing the total number of shares held by the hedge fund to 75,861. The fund now holds a $3.9 million investment in DVA, constituting 0.15% of the firm's holdings. This evaluates to a reduction of -79.69% over the last quarter's 373,500 shares.

Top Holders of DVA

Endurant Capital Management snapped up 70,639 shares of DVA, expanding the total number of shares owned by the fund to 140,729, worth about $7,242,000. This adds up to a growth of 100.78% over the previous quarter's 70,090 shares. Davita now comprises 3.83% of the hedge fund's holdings.

Chou Associates Management has a $7.2 million investment in DVA amounting to 140,743 shares. The hedge fund did not modify its DVA investment in the 3rd quarter, and DVA now represents 3.41% of the hedge fund's stock portfolio.

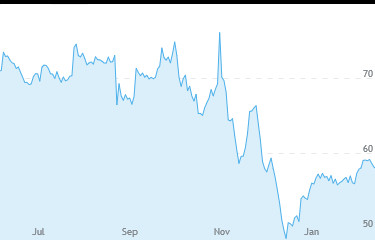

DVA Stock Price

DVA moved negatively 0.43% on Tuesday, reaching a bottom of 58 before going up to end the trading session at 57.99. The stock started trading at 58.14, almost -0.17% under its prior close of 58.24. DVA is hovering 26.7% down from its 12 month high of 79.11 and is 20.19% greater than its TTM low of 48.25. DVA has a very high PE ratio of 72.95. The company has a market capitalization of $9.65B.

DVA moved negatively 0.43% on Tuesday, reaching a bottom of 58 before going up to end the trading session at 57.99. The stock started trading at 58.14, almost -0.17% under its prior close of 58.24. DVA is hovering 26.7% down from its 12 month high of 79.11 and is 20.19% greater than its TTM low of 48.25. DVA has a very high PE ratio of 72.95. The company has a market capitalization of $9.65B.