ABT is among the top 5 positions of Duquesne Family Office

| Travis H.

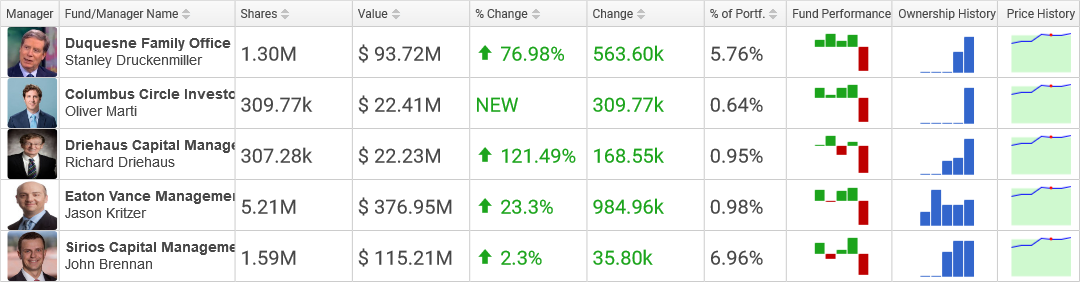

Duquesne Family Office picked up 732,100 shares of ABT in the 2nd quarter and an additional 563,600 shares in the 3rd quarter, bringing the total number of shares held by the fund to 1,295,700. The firm now owns a $93.7 million stake in Abbott Labs, forming 5.76% of the hedge fund's holdings. This equals a growth of 76.98% over the last quarter's 732,100 shares.

Duquesne Family Office picked up 732,100 shares of ABT in the 2nd quarter and an additional 563,600 shares in the 3rd quarter, bringing the total number of shares held by the fund to 1,295,700. The firm now owns a $93.7 million stake in Abbott Labs, forming 5.76% of the hedge fund's holdings. This equals a growth of 76.98% over the last quarter's 732,100 shares. Hedge Funds Buying ABT

Driehaus Capital Management bought 21,704 shares of Abbott Labs in the 2nd quarter and an additional 168,546 shares in the 3rd quarter, bringing the cumulative number of shares held by the fund to 307,278. The firm now holds a $22.2 million position in Abbott Labs, forming 0.95% of the firm's investments. This evaluates to an increase of 121.49% over the last quarter's 138,732 shares.

Eaton Vance Management acquired 74,391 shares of Abbott Labs in the 2nd quarter and an additional 984,962 shares in the 3rd quarter, enlarging the total number of shares held by the hedge fund to 5,211,601. The firm now holds a $377 million stake in ABT, comprising 0.98% of the fund's portfolio. This evaluates to a growth of 23.30% over the previous quarter's 4,226,639 shares.

Hedge Funds Selling ABT

89,074 shares of ABT were off-loaded by Sandler Capital Management, lessening the total number of shares held by the hedge fund to 142,796, valued at $10,328,000. This adds up to a reduction of -38.42% over the previous quarter's 231,870 shares. ABT now comprises 1.71% of the firm's investments.

Steinberg Asset Management has been unloading ABT shares throughout the past year, selling 3,255 shares in the 2nd quarter and another 9,675 shares in the 3rd quarter, deflating the total number of shares held by the fund to 12,837. The hedge fund now holds a $929,000 position in ABT, representing 0.72% of the hedge fund's investments. This amounts to a drop of -42.98% over the previous quarter's 22,512 shares.

Top Holders of ABT

Sivik Global Healthcare owns an $8.3 million investment in Abbott Labs making up 4.48% of the hedge fund's portfolio. The fund's holding of 115,000 shares was not changed in the 3rd quarter

ABT Stock Price

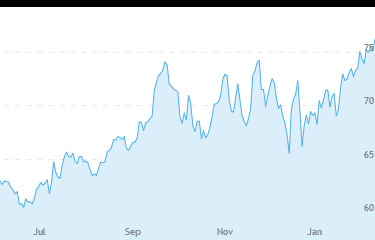

ABT increased 0.97% on February 25th, rising to a high point of 77 before moving lower to finish trading at 76.86. The stock commenced trading at 76.39, approximately 0.35% over its past close of 76.12. ABT is floating within a close range of its TTM high of 77.05 and is more than 30% away from its TTM low of 56.81. ABT has a hefty price/earnings ratio of 57.46 and a relatively small dividend yield of 1.67%. The company has a market capitalization of $134.99 billion.

ABT increased 0.97% on February 25th, rising to a high point of 77 before moving lower to finish trading at 76.86. The stock commenced trading at 76.39, approximately 0.35% over its past close of 76.12. ABT is floating within a close range of its TTM high of 77.05 and is more than 30% away from its TTM low of 56.81. ABT has a hefty price/earnings ratio of 57.46 and a relatively small dividend yield of 1.67%. The company has a market capitalization of $134.99 billion.