Are investment companies bearish on KMX?

| Travis H.

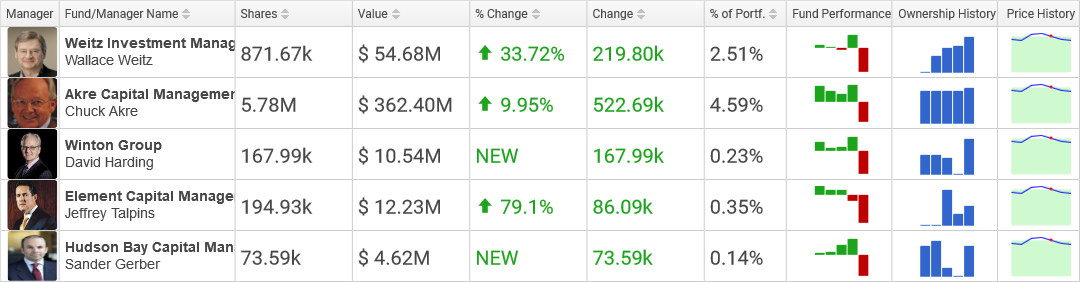

Hedge Funds Buying KMX

Winton Group purchased a new stake in KMX worth about $10.5 million. The firm added 167,986 shares in the last quarter, constituting 0.23% of the firm's investment portfolio.

86,091 shares of KMX were snapped up by Element Capital Management, growing the cumulative number of shares held by the hedge fund to 194,926, valued at $12,228,000. This represents an increase of 79.10% over the previous quarter's 108,835 shares. Carmax now constitutes 0.35% of the hedge fund's investment portfolio.

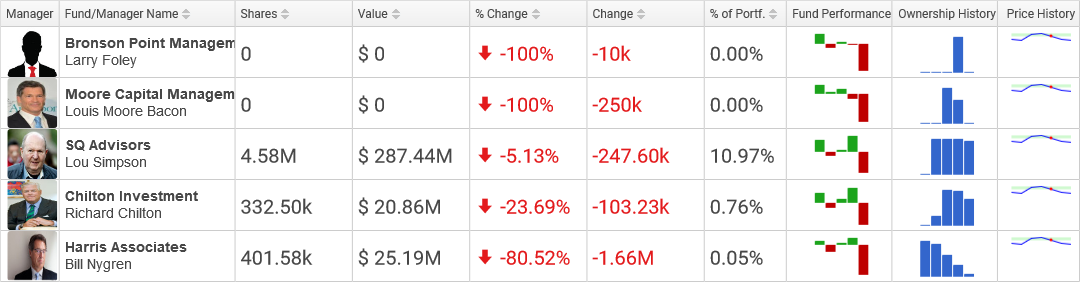

Hedge Funds Selling KMX

Moore Capital Management dumped its $17.2 million investment in Carmax after shrinking its investment in the past several months. The firm sold 125,000 shares in the 2nd quarter and 250,000 more shares in the 3rd quarter.

Chilton Investment has been unloading its holdings in Carmax during the past several months, unloading 13,001 shares in the 2nd quarter and 103,226 more shares in the 3rd quarter, dwindling the total number of shares owned by the firm to 332,497. The hedge fund now owns a $20.9 million stake in Carmax, forming 0.76% of the hedge fund's holdings. This adds up to a reduction of -23.69% over the prior quarter's 435,723 shares.

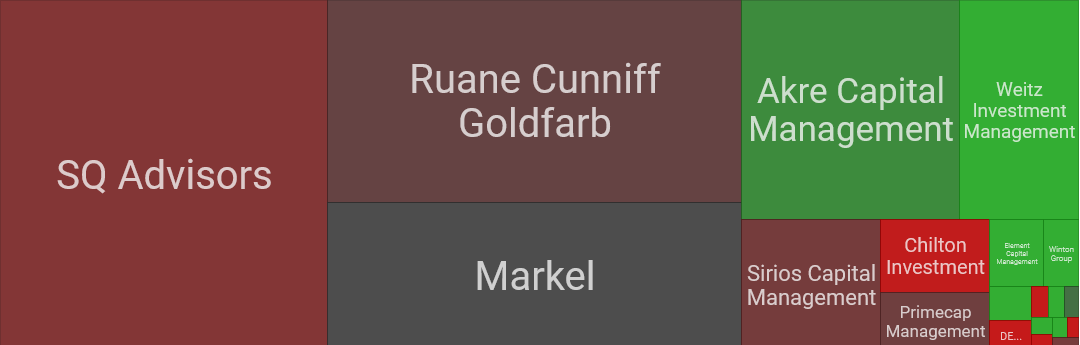

Top Holders of KMX

Ruane Cunniff Goldfarb has been trading away Carmax shares in the last few quarters, disposing off 207,305 shares in the 2nd quarter and another 114,005 shares in the 3rd quarter, deflating the total number of shares owned by the firm to 11,628,794. The fund now has a $729.5 million stake in KMX, making up 8.03% of the fund's holdings. This equals a reduction of -0.97% over the prior quarter's 11,742,799 shares.

KMX Stock Price

KMX moved 1.24% on February 25, decreasing to a low of 60 before going up to cease trading at 59.80. The stock kick started the day at 60.98, almost 0.71% above its past close of 60.55. KMX is floating 26.78% away from its 12 month high of 81.67 and is quite close to its TTM low of 55.24. KMX has a smallish P/E ratio of 13.80. The company has a mkt cap of $10.17 billion.

KMX moved 1.24% on February 25, decreasing to a low of 60 before going up to cease trading at 59.80. The stock kick started the day at 60.98, almost 0.71% above its past close of 60.55. KMX is floating 26.78% away from its 12 month high of 81.67 and is quite close to its TTM low of 55.24. KMX has a smallish P/E ratio of 13.80. The company has a mkt cap of $10.17 billion.