Are investment funds bearish on AMT?

| Bradley S.

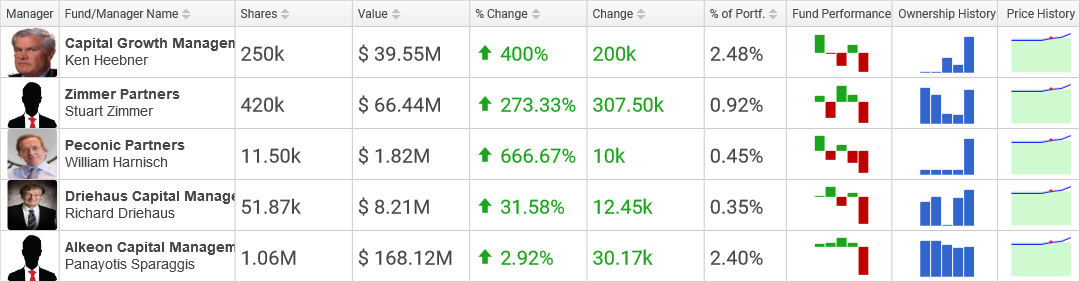

Hedge Funds Buying AMT

After the acquisition of 10,000 shares, Peconic Partners now owns a $1.8 million investment in American Tower consisting of 11,500 shares. American Tower now accounts for 0.45% of the hedge fund's holdings. This equals an increase of 666.67% over the prior quarter's 1,500 shares.

Driehaus Capital Management has been accumulating American Tower shares throughout the last year, acquiring 39,420 shares in the 2nd quarter and an additional 12,447 shares in the 3rd quarter, enlarging the cumulative number of shares owned by the fund to 51,867. The hedge fund now holds an $8.2 million investment in American Tower, comprising 0.35% of the hedge fund's stock portfolio. This amounts to a growth of 31.58% over the prior quarter's 39,420 shares.

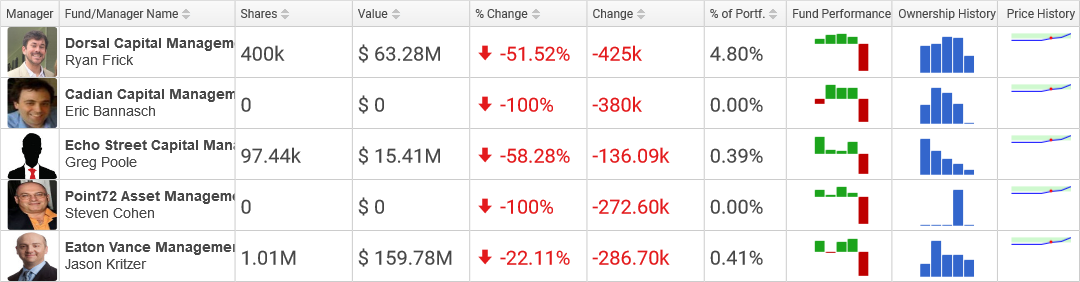

Hedge Funds Selling AMT

Echo Street Capital Management dumped 124,468 shares of AMT in the 2nd quarter and another 136,093 shares in the 3rd quarter, diminishing the cumulative number of shares owned by the hedge fund to 97,441. The hedge fund now has a $15.4 million stake in American Tower, constituting 0.39% of the hedge fund's stock portfolio. This equals a reduction of -58.28% over the prior quarter's 233,534 shares.

Point72 Asset Management closed out its $41.4 million stake in American Tower. The firm unloaded 272,600 shares of the stock over the previous quarter.

Top Holders of AMT

Dorsal Capital Management unloaded 25,000 shares of AMT in the 2nd quarter and another 425,000 shares in the 3rd quarter, lessening the cumulative number of shares held by the fund to 400,000. The hedge fund now has a $63.3 million stake in American Tower, comprising 4.80% of the hedge fund's stock portfolio. This equals a decrease of -51.52% over the prior quarter's 825,000 shares.

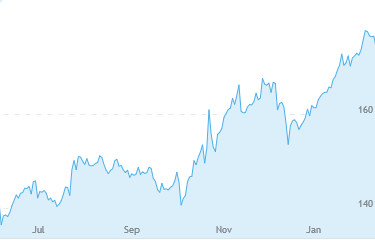

AMT Stock Price

AMT dropped 1.36% on February 25th, going down to a trough of 174 before rising up to end the trading session at 174.23. The stock began the day at 177.24, nearly 0.35% over its prior close of 176.63. AMT is hovering a long distance away from its TTM low of 132.02 and is close to its year high price of 178.32. AMT has a very high PE ratio of 66.34 and a relatively small dividend yield of 1.93%. The company has a mkt cap of $76.75 billion.

AMT dropped 1.36% on February 25th, going down to a trough of 174 before rising up to end the trading session at 174.23. The stock began the day at 177.24, nearly 0.35% over its prior close of 176.63. AMT is hovering a long distance away from its TTM low of 132.02 and is close to its year high price of 178.32. AMT has a very high PE ratio of 66.34 and a relatively small dividend yield of 1.93%. The company has a mkt cap of $76.75 billion.