David Tepper's hedge fund has been racking up VST shares over the past few quarters

| Roger A.

Appaloosa has been racking up VST shares throughout the previous several months, snapping up 112,794 shares in the 2nd quarter and 548,998 additional shares in the 3rd quarter, enlarging the cumulative number of shares owned by the hedge fund to 2,532,743. The firm now has a $58 million stake in Vistra Energy, representing 2.87% of the fund's portfolio. This amounts to a growth of 27.67% over the past quarter's 1,983,745 shares.

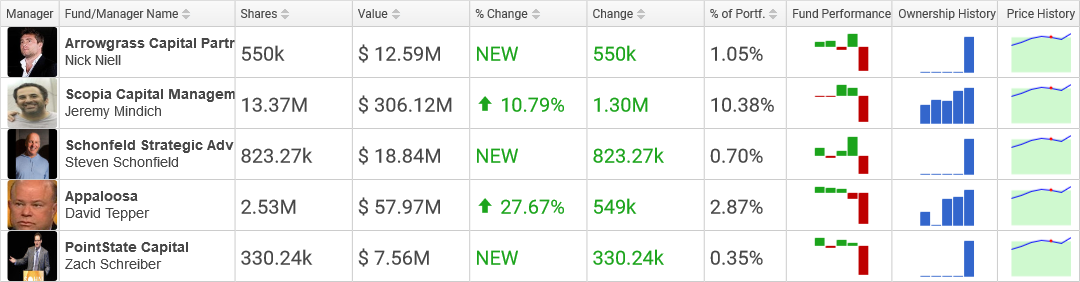

Appaloosa has been racking up VST shares throughout the previous several months, snapping up 112,794 shares in the 2nd quarter and 548,998 additional shares in the 3rd quarter, enlarging the cumulative number of shares owned by the hedge fund to 2,532,743. The firm now has a $58 million stake in Vistra Energy, representing 2.87% of the fund's portfolio. This amounts to a growth of 27.67% over the past quarter's 1,983,745 shares. Hedge Funds Buying VST

Schonfeld Strategic Advisors bought a new position in Vistra Energy valued at $18.8 million. The fund acquired 823,274 shares throughout the prior quarter, constituting 0.70% of the fund's portfolio.

PointState Capital acquired a new stake in Vistra Energy valued at $7.6 million. The hedge fund purchased 330,235 shares over the last quarter, representing 0.35% of the hedge fund's investments.

Hedge Funds Selling VST

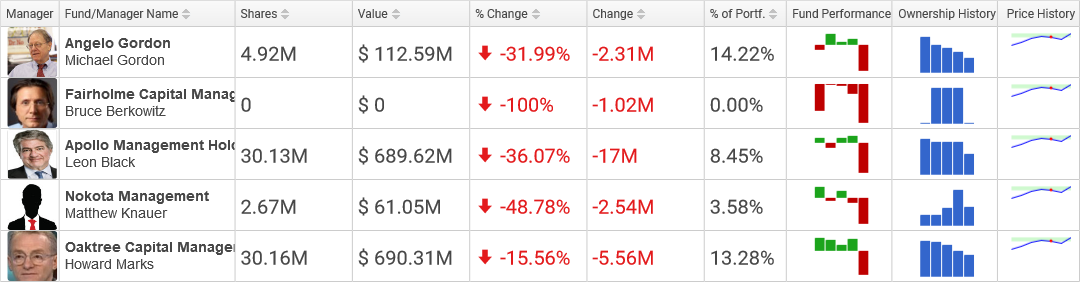

Apollo Management Holdings dumped 17,000,000 shares of VST, lessening the aggregate number of shares held by the hedge fund to 30,127,762, worth about $689,624,000. This amounts to a decrease of -36.07% over the prior quarter's 47,127,762 shares. VST now makes up 8.45% of the firm's investments.

Nokota Management reduced its investment in Vistra Energy by 2,539,739 shares, decreasing the aggregate number of shares held by the firm to 2,667,137, worth about $61,051,000. This represents a reduction of -48.78% over the past quarter's 5,206,876 shares. VST now accounts for 3.59% of the hedge fund's portfolio.

Top Holders of VST

Angelo Gordon sold 1,330,000 shares of Vistra Energy in the 2nd quarter and 2,313,357 additional shares in the 3rd quarter, lessening the total number of shares owned by the firm to 4,918,615. The fund now has a $112.6 million investment in VST, representing 14.22% of the hedge fund's investments. This represents a drop of -31.99% over the previous quarter's 7,231,972 shares.

Oaktree Capital Management has been lessening its position in VST during the past year, disposing off 8,837,694 shares in the 2nd quarter and another 5,557,466 shares in the 3rd quarter, lessening the cumulative number of shares held by the hedge fund to 30,157,877. The fund now owns a $690.3 million investment in Vistra Energy, constituting 13.28% of the fund's portfolio. This represents a drop of -15.56% over the previous quarter's 35,715,343 shares.

VST Stock Price

VST went down 1.05% on February 26, slipping to a trough of 26 before leveling up to finish trading at 26.28. The stock kick started the day at 26.61, about 0.19% from its last close of 26.56. VST is hovering near its year high price of 27.01 and is faraway from its 12 month low of 18.44. VST has a hefty PE ratio of 57.06. The company has a mkt cap of $13.26B.

VST went down 1.05% on February 26, slipping to a trough of 26 before leveling up to finish trading at 26.28. The stock kick started the day at 26.61, about 0.19% from its last close of 26.56. VST is hovering near its year high price of 27.01 and is faraway from its 12 month low of 18.44. VST has a hefty PE ratio of 57.06. The company has a mkt cap of $13.26B.