How did institutional investors revise their holdings in Progressive?

| Bradley S.

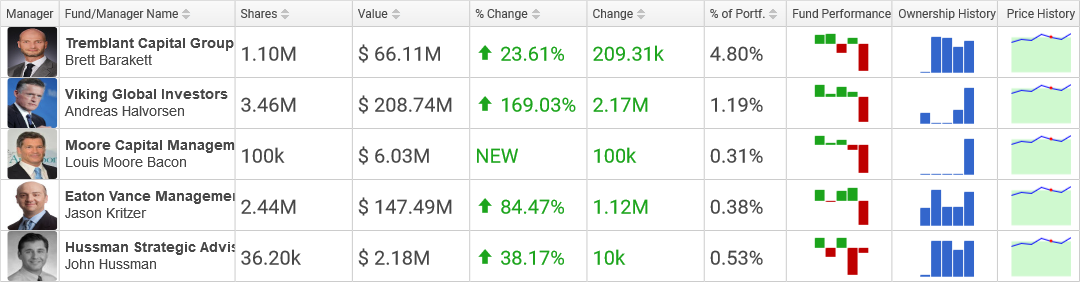

Hedge Funds Buying PGR

Eaton Vance Management bought 1,119,423 shares of PGR, boosting the aggregate number of shares held by the hedge fund to 2,444,668, worth about $147,487,000. This amounts to an increase of 84.47% over the prior quarter's 1,325,245 shares. PGR now makes up 0.38% of the firm's stock portfolio.

Hussman Strategic Advisors boosted its position in Progressive by 10,000 shares, increasing the aggregate number of shares owned by the firm to 36,200, worth about $2,184,000. This represents a growth of 38.17% over the last quarter's 26,200 shares. PGR now forms 0.53% of the hedge fund's investments.

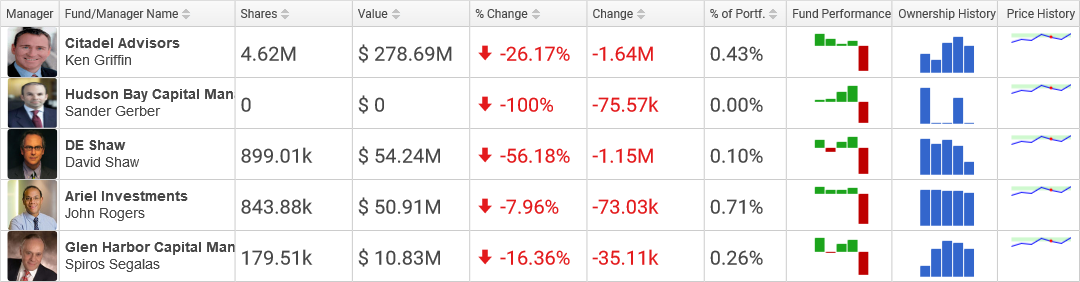

Hedge Funds Selling PGR

Hudson Bay Capital Management off-loaded its $5 million investment in Progressive. The fund unloaded 75,574 shares of the stock throughout the previous quarter.

DE Shaw off-loaded 397,620 shares of Progressive in the 2nd quarter and 1,152,804 additional shares in the 3rd quarter, dwindling the cumulative number of shares held by the hedge fund to 899,013. The firm now has a $54.2 million position in Progressive, representing 0.10% of the hedge fund's investments. This evaluates to a decline of -56.18% over the last quarter's 2,051,817 shares.

Top Holders of PGR

Viking Global Investors acquired 1,286,070 shares of Progressive in the 2nd quarter and an additional 2,173,871 shares in the 3rd quarter, expanding the cumulative number of shares held by the hedge fund to 3,459,941. The fund now owns a $208.7 million stake in PGR, constituting 1.19% of the firm's holdings. This evaluates to an increase of 169.03% over the prior quarter's 1,286,070 shares.

Zweig DiMenna Associates owns a $11.3 million investment in PGR composed of 186,920 shares. The firm did not modify its PGR position in the 3rd quarter, and PGR now constitutes 1.14% of the fund's stock portfolio.

PGR Stock Price

PGR moved positively 0.64% on February 25th, increasing to a high of 73 before leveling off to end the trading session at 72.73. The stock kicked off at 72.53, roughly 0.36% from its prior close of 72.27. PGR is drifting quite close to its year high price of 73.69 and is 28.25% up from its 12 month low of 56.71. PGR has a significant dividend yield of 3.46% and a PE ratio of 16.43. The company has a mkt cap of $42.47 billion.

PGR moved positively 0.64% on February 25th, increasing to a high of 73 before leveling off to end the trading session at 72.73. The stock kicked off at 72.53, roughly 0.36% from its prior close of 72.27. PGR is drifting quite close to its year high price of 73.69 and is 28.25% up from its 12 month low of 56.71. PGR has a significant dividend yield of 3.46% and a PE ratio of 16.43. The company has a mkt cap of $42.47 billion.