Several institutional investors have been changing their investments in Canadian Pacific

| Steve G.

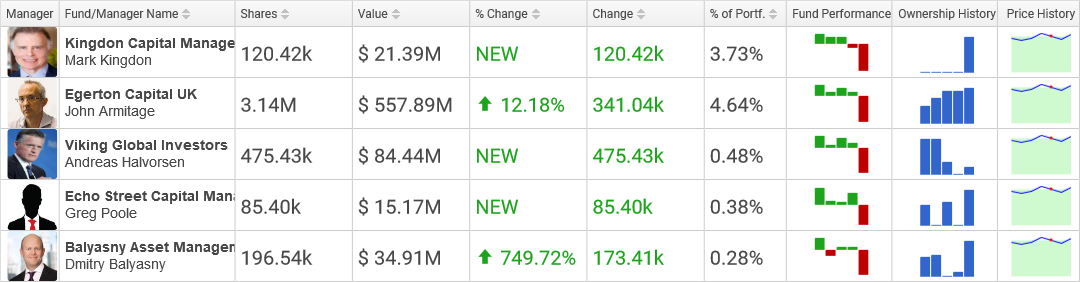

Hedge Funds Buying CP

Echo Street Capital Management bought a new $15.2 million position in Canadian Pacific. The fund snapped up 85,404 shares in the previous quarter, constituting 0.38% of the firm's holdings.

Balyasny Asset Management has been enlarging its holdings in CP during the last several months, snapping up 23,130 shares in the 2nd quarter and an additional 173,411 shares in the 3rd quarter, enlarging the cumulative number of shares held by the firm to 196,541. The fund now holds a $34.9 million investment in CP, constituting 0.28% of the firm's holdings. This represents a growth of 749.72% over the last quarter's 23,130 shares.

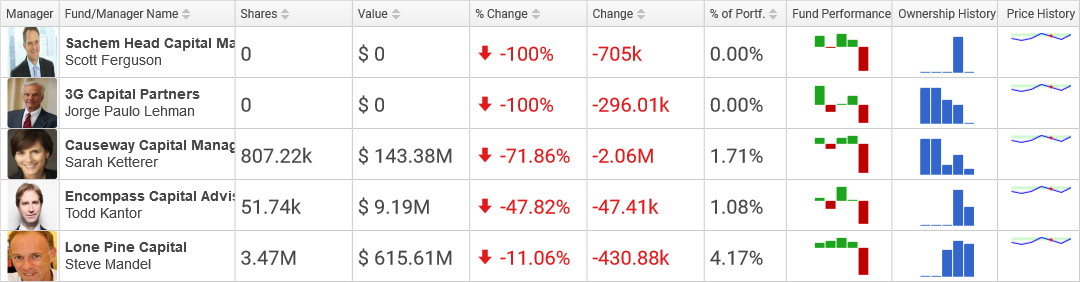

Hedge Funds Selling CP

3G Capital Partners dumped its $57.7 million holdings in CP after dumping its CP shares throughout the prior few quarters. The firm dumped 92,581 shares in the 2nd quarter and another 296,015 shares in the 3rd quarter.

Causeway Capital Management decreased its stake in Canadian Pacific by 2,061,857 shares, reducing the aggregate number of shares owned by the hedge fund to 807,218, worth about $143,378,000. This equals a decrease of -71.86% over the last quarter's 2,869,075 shares. CP now represents 1.71% of the hedge fund's investment portfolio.

Top Holders of CP

Lone Pine Capital dimished its holdings in CP by 430,875 shares, decreasing the cumulative number of shares owned by the hedge fund to 3,465,872, worth about $615,608,000. This evaluates to a decline of -11.06% over the last quarter's 3,896,747 shares. CP now comprises 4.17% of the fund's stock portfolio.

120,417 shares of CP were purchased by Kingdon Capital Management, enlarging the aggregate number of shares owned by the firm to 120,417, worth about $21,388,000. This adds up to an increase of% over the prior quarter's 0 shares. CP now accounts for 3.73% of the hedge fund's holdings.

Following the sale of 500 shares by Heronetta Management, Canadian Pacific now comprises 2.91% of the hedge fund's investment portfolio. This adds up to a reduction of -2.08% over the prior quarter's 24,000 shares.

CP Stock Price

CP went up 0.40% on Monday, increasing to a high of 210 before falling to end the trading session at 208.73. The stock opened at 208.15, around 0.13% over its past close of 207.89. CP is trading in a small neighborhood of its 12 month high of 224.19 and is 24.63% on top of its TTM low of 167.48. CP has a modest dividend yield of 0.96% and a P/E ratio of 16.67. The company has a mkt cap of $29.11 billion.

CP went up 0.40% on Monday, increasing to a high of 210 before falling to end the trading session at 208.73. The stock opened at 208.15, around 0.13% over its past close of 207.89. CP is trading in a small neighborhood of its 12 month high of 224.19 and is 24.63% on top of its TTM low of 167.48. CP has a modest dividend yield of 0.96% and a P/E ratio of 16.67. The company has a mkt cap of $29.11 billion.