Which investment companies changed their holdings in AMAT?

| Steve G.

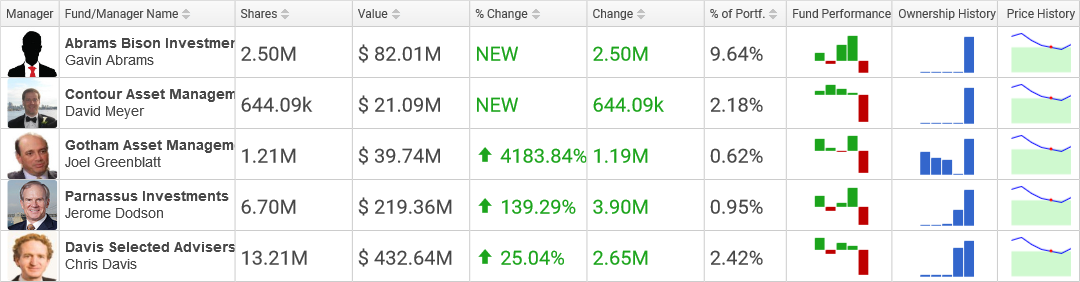

Hedge Funds Buying AMAT

Parnassus Investments has been amassing AMAT shares throughout the previous year, picking up 2,500,000 shares in the 2nd quarter and 3,900,000 more shares in the 3rd quarter, expanding the total number of shares owned by the hedge fund to 6,700,000. The hedge fund now owns a $219.4 million investment in Applied Materials, forming 0.96% of the hedge fund's portfolio. This adds up to a growth of 139.29% over the prior quarter's 2,800,000 shares.

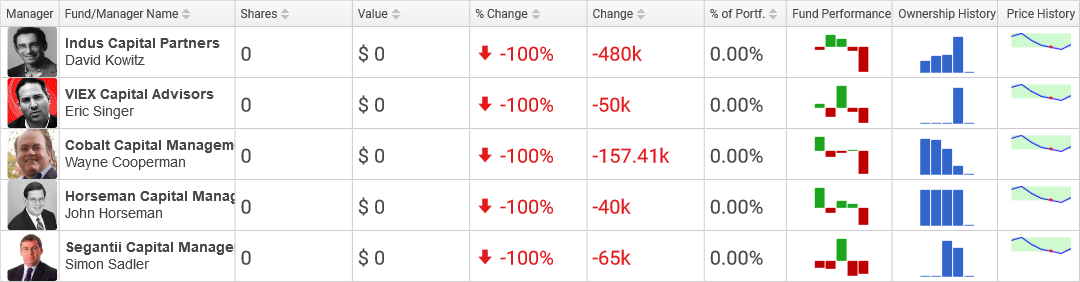

Hedge Funds Selling AMAT

VIEX Capital Advisors sold all its 50,000 shares of AMAT over the prior quarter, dumping its $1.8 million investment in the company

Cobalt Capital Management closed out its $5.6 million position in AMAT after decreasing its position over the last year. The hedge fund sold 291,000 shares in the 2nd quarter and an additional 157,414 shares in the 3rd quarter.

Top Holders of AMAT

Davis Selected Advisers purchased 10,052,435 shares of Applied Materials in the 2nd quarter and 2,646,045 more shares in the 3rd quarter, growing the aggregate number of shares owned by the fund to 13,214,457. The firm now owns a $432.6 million position in Applied Materials, making up 2.42% of the hedge fund's investments. This adds up to a growth of 25.04% over the past quarter's 10,568,412 shares.

Contour Asset Management increased its position in Applied Materials by 644,089 shares, growing the cumulative number of shares held by the fund to 644,089, valued at $21,087,000. This amounts to a growth of% over the past quarter's 0 shares. Applied Materials now represents 2.18% of the fund's portfolio.

Maverick Capital has been adding to its holdings in AMAT during the previous year, loading up 1,523,017 shares in the 2nd quarter and 980,482 more shares in the 3rd quarter, enlarging the cumulative number of shares owned by the hedge fund to 2,682,479. The hedge fund now owns an $87.8 million position in Applied Materials, making up 1.29% of the firm's investments. This evaluates to an increase of 57.61% over the previous quarter's 1,701,997 shares.

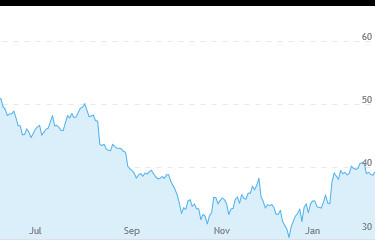

AMAT Stock Price

AMAT moved positively 1.55% on Friday, climbing to a high point of 39 before moving downwards to finish trading at 39.43. The stock kicked off at 38.89, about 0.15% from its previous close of 38.83. AMAT is drifting quite far from its year low price of 28.79 and is very far from its TTM high of 62.40. AMAT has a dividend yield of 2.03% and a small PE ratio of 10.01. The company has a market cap of $37.43B.

AMAT moved positively 1.55% on Friday, climbing to a high point of 39 before moving downwards to finish trading at 39.43. The stock kicked off at 38.89, about 0.15% from its previous close of 38.83. AMAT is drifting quite far from its year low price of 28.79 and is very far from its TTM high of 62.40. AMAT has a dividend yield of 2.03% and a small PE ratio of 10.01. The company has a market cap of $37.43B.