Which investment firms changed their investments in Owens Corning?

| Matthew D.

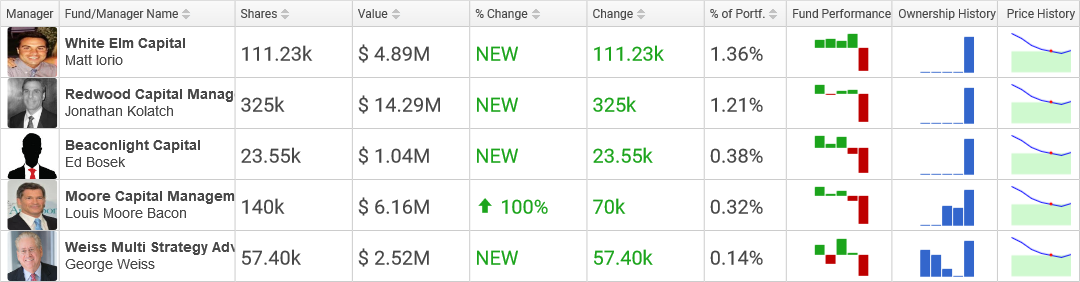

Hedge Funds Buying OC

Moore Capital Management snapped up 70,000 shares of OC, expanding the aggregate number of shares owned by the hedge fund to 140,000, valued at $6,157,000. This adds up to an increase of 100.00% over the last quarter's 70,000 shares. OC now makes up 0.32% of the firm's holdings.

Weiss Multi Strategy Advisers bought a new position in Owens Corning valued at $2.5 million. The fund snapped up 57,400 shares during the prior quarter, constituting 0.14% of the fund's portfolio.

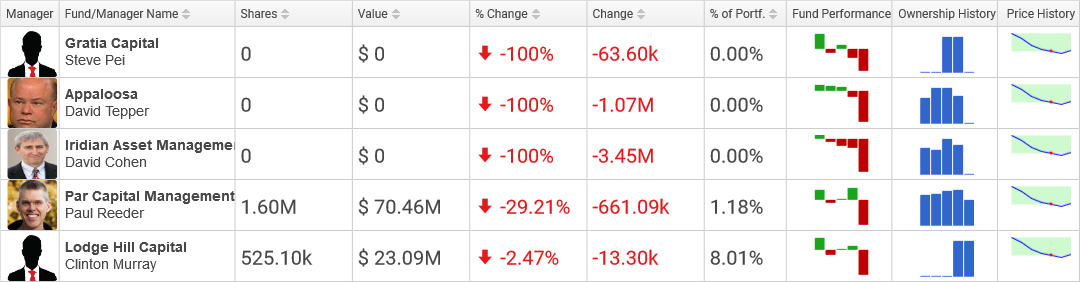

Hedge Funds Selling OC

Appaloosa closed out its $52.8 million stake in OC after dumping its OC shares during the past several months. The firm disposed off 335,351 shares in the 2nd quarter and 1,073,813 more shares in the 3rd quarter.

Iridian Asset Management liquidated its $169.5 million investment in Owens Corning after reducing its investment in the past few quarters. The firm off-loaded 770,242 shares in the 2nd quarter and 3,450,584 more shares in the 3rd quarter.

Top Holders of OC

White Elm Capital purchased 111,233 shares of OC, boosting the total number of shares owned by the hedge fund to 111,233, worth about $4,892,000. This represents an increase of% over the prior quarter's 0 shares. Owens Corning now represents 1.36% of the fund's stock portfolio.

325,000 shares of OC were bought by Redwood Capital Management, growing the aggregate number of shares held by the hedge fund to 325,000, valued at $14,294,000. This evaluates to an increase of% over the prior quarter's 0 shares. Owens Corning now makes up 1.21% of the firm's investment portfolio.

661,086 shares of OC were sold by Par Capital Management, dwindling the cumulative number of shares owned by the firm to 1,602,144, worth about $70,462,000. This equals a decrease of -29.21% over the past quarter's 2,263,230 shares. Owens Corning now represents 1.18% of the hedge fund's holdings.

OC Stock Price

OC moved down 0.99% on February 22nd, moving downwards to a low point of 51 before leveling up to finish trading at 51.12. The stock kick started the day at 51.43, around -0.39% lower than its last close of 51.63. OC is floating 25.79% from its 12 month low of 40.64 and is more than 30% away from its year high price of 86.22. OC has a somewhat small div. yield of 1.72% and a small P/E ratio of 10.44. The company has a market cap of $5.59 billion.

OC moved down 0.99% on February 22nd, moving downwards to a low point of 51 before leveling up to finish trading at 51.12. The stock kick started the day at 51.43, around -0.39% lower than its last close of 51.63. OC is floating 25.79% from its 12 month low of 40.64 and is more than 30% away from its year high price of 86.22. OC has a somewhat small div. yield of 1.72% and a small P/E ratio of 10.44. The company has a market cap of $5.59 billion.